kern county property tax rate 2021

The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County. Kern County CA Home Menu.

Study Oil And Gas Industry Contributed More Than 197m To Kern County Last Year

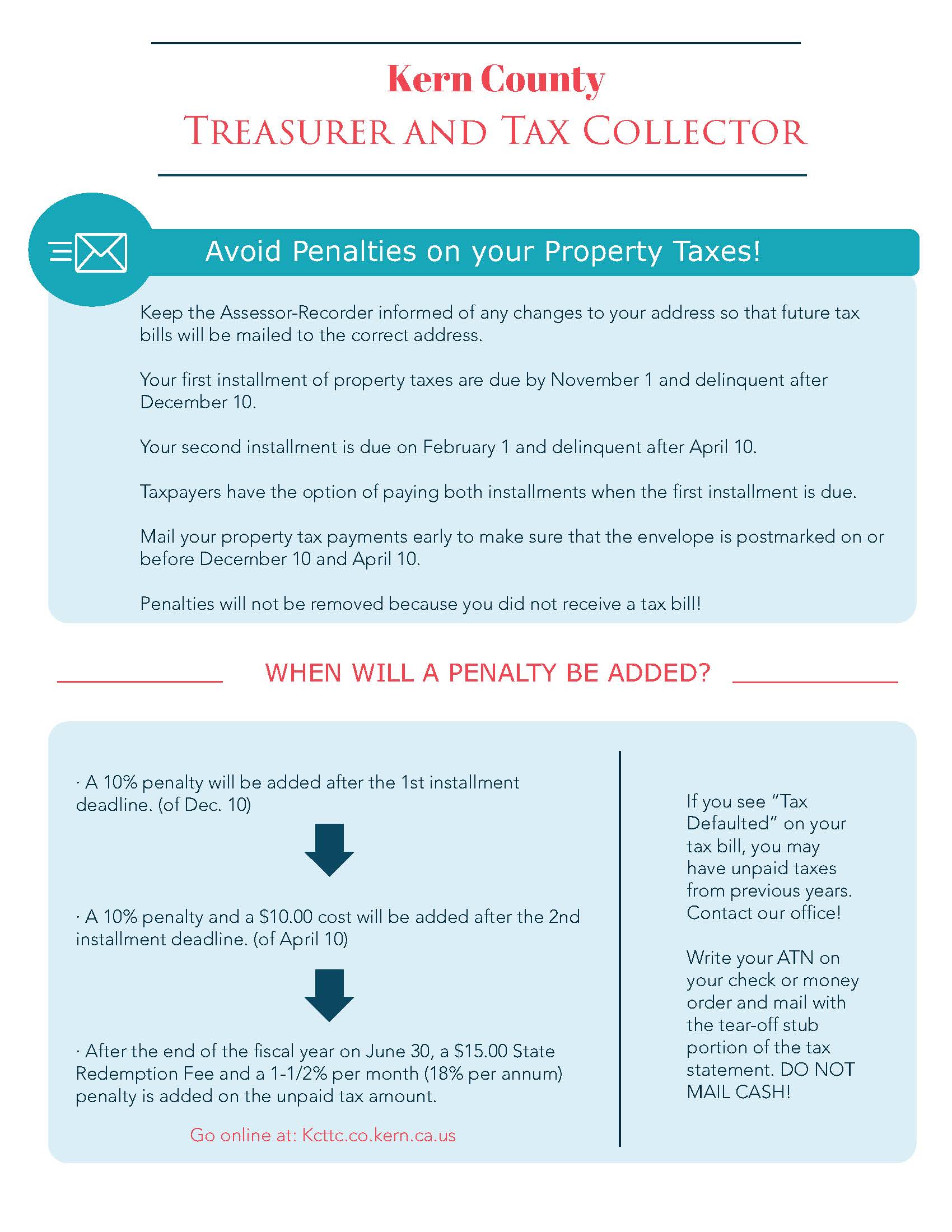

Treasurer-Tax Collector mails delinquent notices for any unpaid regular current taxes.

. Tax rate set by County Sanitary and Sanitation Districts. The Treasurer-Tax Collector collects all property taxes. Kern County real property taxes are due by 5 pm.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Election to Establish an Installment Plan. Property Taxes - Pay Online.

COUNTY OF KERN TAX RATES AND ASSESSED VALUATIONS 2021-2022 COMPILED BY THE OFFICE OF MARY B. Information in all areas for Property Taxes. Q32021 Q42021 Q12022 Q22022.

More than 70 of all taxes collected is allocated to 120 governing boards of schools cities and special districts. A 10 penalty plus 1000 cost is added as of 500 pm. 2020-2021 Annual Property Tax Rate Book.

The median property tax also. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. You have the right.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Establecer un Plan de Pagos. While many other states allow counties and other localities to collect a local option sales tax.

Auditor - Controller - County Clerk. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. The Kern County California sales tax is 725 the same as the California state sales tax.

1115 Truxtun Avenue Bakersfield CA 93301-4639. Comprehensive frequently updated all in one place. Kern County CA Home Menu.

A 10 penalty plus 1000 cost is added as of 500 pm. Request For Escape Assessment Installment Plan. Property Taxes - Pay by Wire.

2019-2020 Annual Property Tax. Kern County property data. Visit Treasurer-Tax Collectors site.

Treasurer-Tax Collector mails delinquent notices for any unpaid regular current taxes. Kern County CA Home Menu. Application for Tax Penalty Relief.

Kern County collects on average 08 of a propertys assessed fair. Commercial sales stats in Kern County. 2021 Proposition 19 allows persons over 55.

Dec 8 2021.

Kern County Property Tax Payments Due December 10th

Kern County California Oil Gas Environmental Impact Report

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Change Of Plans Kern Co Fair Is Back For 2021

Kern County California Wikipedia

Property Tax By County Property Tax Calculator Rethority

Is Bakersfield A Good Place To Live Ultimate Moving To Bakersfield Ca Guide Mentors Moving Storage

San Diego Property Taxes In California Prop 15

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Property Tax Portal Kern County Ca

Kern County Court Forms Fill Online Printable Fillable Blank Pdffiller

Kern County Taxpayers Association Kern County Taxpayers Association

Kern County Treasurer And Tax Collector

First Installment Of Real Property Taxes Due Dec 10 News Bakersfield Com

Property Tax California H R Block

Property Tax By County Property Tax Calculator Rethority

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa